May 25, 2021

"Dread that fills you with horror." That's how a customer named QCX-INT described his reaction to the collapse two years ago of QuadrigaCX, Canada's largest cryptocurrency exchange, where he had upwards of six figures in cash tied up.

It was the end of January 2019, and QuadrigaCX had just filed for creditor protection in the Supreme Court of Nova Scotia. The announcement followed news that Gerald Cotten, the company's 30-year-old CEO, had reportedly died under peculiar circumstances the month before, while on his honeymoon in India.

On the morning of Dec. 8, Cotten complained of a stomach ache. That day he and his wife, Jennifer Robertson, checked into the luxury resort Oberoi Rajvilas in Jaipur and told staff he wasn't well. The hotel's general manager drove them to a nearby hospital and within 24 hours, Cotten was declared dead.

- Listen to the podcast A Death in Cryptoland

That's when things took a bizarre turn. According to reports, a doctor was asked to embalm the body, but refused because the request had come from a hotel employee, not the hospital. Cotten's body was then transported — although it is unclear how — to another facility that accepted the corpse for embalming.

In the weeks following Cotten's trip to India, the company kept the death a secret. It was business as usual, with the exchange continuing to accept customer funds. It took more than a month for QuadrigaCX to publicly announce Cotten's death — and then another two weeks for Jennifer Robertson to admit the customer funds were inaccessible.

“I smelled a rat. Many people did.”

She said her husband was the only person who had the passcodes — that is, access to more than a quarter of a billion dollars of his customers' money. She made this startling admission in an affidavit filed in court, and it led to chaos and confusion online. Creditors were in a panic.

"A collective gasp is a good description," said Alex Salkeld, a bitcoin enthusiast from Vancouver. He couldn't believe what he was hearing. "It was definitely a case of, 'Really? Are you sure, guys?'"

Salkeld knew both Cotten and his business partner, Michael Patryn, personally, and watched the drama unfold on social media and in news reports. Internet sleuths scoured the blockchain — the public ledger that tracks cryptocurrency transactions — looking for patterns that would lead them to their funds. Among them was QCX-INT.

"For someone [Cotten's] age, a relatively young guy, to suddenly drop dead, you know, holding the keys to tens of millions of dollars, I think is a shock to most people," said QCX-INT.

"I smelled a rat," he said. "Many people did."

CBC has agreed not to identify QCX-INT, because he fears for his family's safety. A software developer by day, he traded big on bitcoin using a practice called arbitrage. That meant tracking the volatile prices of the digital currency on exchanges around the world in order to buy low, sell high and turn a profit.

In the days after Cotten's death was announced, QCX-INT noticed inconsistencies between what Quadriga was saying about losing the passcodes to the cold wallet reserves — where the bulk of the crypto assets are stored offline for security reasons — and what he and other traders actually saw on the blockchain.

"You would normally be able to see a pattern of deposits being swept to hot wallets [online], then hot wallets to cold wallets," he said. "The difference [with] Quadriga was you couldn't really find any cold wallets. There was just a series of hot wallets, and in turn those hot wallets seemed to be replenished with funds from other exchanges, which again is weird," he said. "Just some very, very shady, strange activity."

When QCX-INT couldn't locate the cold wallets, it dawned on him that the money was gone. In that moment, he had to lie down on the floor. He looked up at the ceiling for a long time as the weight of his loss began to sink in.

"It was the first kick in the guts of many, shall we say."

LISTEN | Episode 1 of A Death in Cryptoland:

The news of Cotten's demise set off wild theories on social media, including speculation that he had faked his own death. So the man behind the handle QCX-INT began an investigation, following a virtual trail he hoped would ultimately lead to their missing funds.

"I was absolutely committed to doing a comprehensive report and a report in a form that could be provided to … investigators that was based on evidence, not hearsay, not conspiracy theories."

What he would uncover would change the course of this story. Without him, the narrative would likely have ended with the death of a young CEO taking his secrets and keys to a fortune to his grave.

By documenting a detailed web of connections, QCX-INT uncovered a pattern of fraud that predated Quadriga, linking Cotten and his former business partner to a shadowy underworld of fraudsters and money launderers — the criminal element that underpinned the very origins of digital currency.

II. The disruptor

Gerald Cotten's career trajectory appeared to follow that of the stereotypical internet-nerd-turns-tycoon story. He was a small-town Canadian boy who seemed to have the Midas touch.

Cotten grew up in Belleville, Ont., two hours east of Toronto. His parents, Bruce and Cheryl, ran a business selling antiques and collectibles just off the main highway. While the Cottens sold vintage jewelry and furniture, "Gerry" showed an early interest in the new digital frontier.

Scott Giroux, who went to the same high school as Cotten, said he didn't have many friends. "Gerry kind of kept to himself for the most part. I never knew him to be overly social. You know, occasionally kind of one-on-one, you might be able to have a bit of a conversation with him," he said. Giroux described him as "nerdy" and into sci-fi, with a goofy sense of humour.

What really stood out for Giroux was Cotten's love for technology. "He was just always leaps and bounds beyond most of the computer teachers."

Giroux remembered Cotten rushing through assignments in class so he could spend more time finding ways around the firewalls blocking certain websites at school, which would allow him to play online games in class.

His high school math teacher, who asked not to be identified, said Cotten hired people on the internet to build code for him. The teacher said he was smart, had an interest in money and was always "looking for an angle."

After high school, Cotten went to study at York University in Toronto, graduating from the Schulich School of Business in 2010. Three years later, he and business partner Michael Patryn launched the cryptocurrency exchange QuadrigaCX.

Patryn worked mostly behind the scenes, while Cotten was the face of the company. That meant evangelizing about bitcoin on YouTube and at events and conferences organized by crypto enthusiasts. He billed himself as a disruptor who would challenge traditional forms of banking.

During a guest appearance on a Vancouver podcast called True Bromance in 2014, Cotten said he wasn't actually promoting a business, but a new way of thinking. Bitcoin, he explained, is a peer-to-peer network, and the cryptocurrency is traded and stored with the use of a decentralized ledger called the blockchain. The transactions are public, but users' identities remain anonymous.

"It essentially removes the need for a central authority. Then you get rid of the fees. You get rid of a lot of the regulations," Cotten said. "It's pretty much money by people for people."

QuadrigaCX was a platform where people could trade bitcoin and other cryptocurrencies. "Kind of like a stock exchange," Cotten said.

Over the next four years, the platform would reach heights even Cotten couldn't have possibly imagined, handling hundreds of millions of dollars' worth of transactions, and with tens of thousands of customers. The success of the company reflected the meteoric rise of bitcoin in 2017, which started the year valued at around $900 US and by mid-December was almost $20,000.

"Nobody had ever seen that before. It was a spectacular run-up," said Amy Castor, a freelance journalist who covers cryptocurrencies and financial fraud and was one of the first to report on Cotten's early history, on her blog. "A lot of money was flowing into [QuadrigaCX] before then. Everybody wanted to get into cryptocurrency, hoping they could make money for nothing." That is, a get-rich-quick scheme.

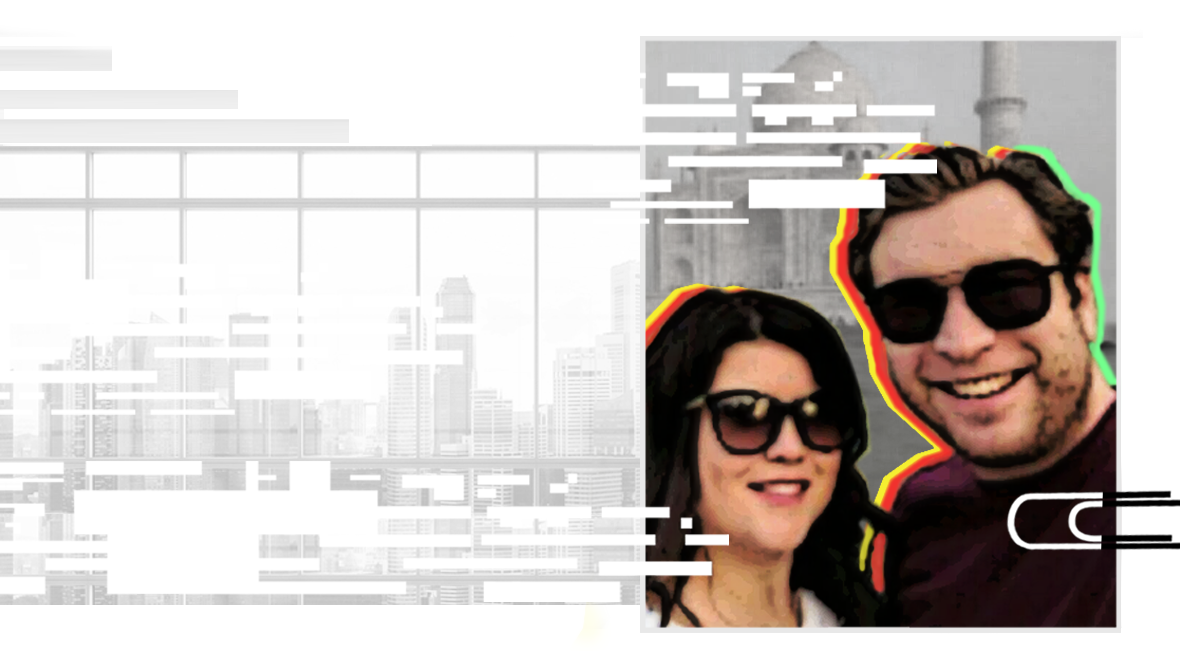

As the value of bitcoin was rising and more people entrusted their money with QuadrigaCX, Cotten was snatching up properties in Nova Scotia and British Columbia with his soon-to-be wife, Jennifer Robertson. He also purchased luxury vehicles, a yacht and a Cessna aircraft. They were living the high life and went on lavish vacations. Cotten once boasted that he had traveled to 56 countries, 37 of them with Robertson.

By 2018, however, their fortunes were turning. The crypto bubble had burst and the price of bitcoin was in a free fall. By the end of that year, it was below $4,000. Throughout that time, many Quadriga customers tried to pull their money off of the exchange in an attempt to cut their losses. A few others continued buying, placing their bets on the possibility that the price of bitcoin would go back up.

But that meant Cotten had less cash needed to pay out the withdrawal requests. There were news reports of delays, with some customers waiting months for their money to be processed.

When bitcoin exchanges "start having withdrawal delays, that's when you start worrying. And that's when you get your money out," said Salkeld, the Vancouver bitcoiner. "The withdrawals [at QuadrigaCX] sped up and then it didn't take long before the withdrawals outnumbered the deposits."

Cotten had other problems, too. Among them: CIBC had frozen $26 million Cdn of the company's money because of suspicious activity, and another $10 million Cdn had been made inaccessible by a software bug.

In the middle of this tumultuous year, Cotten and Robertson got married. At the end of November, on the advice of their lawyer, just days before their honeymoon in India, Cotten made out a will, leaving everything — the properties, digital assets, even his frequent flyer points — to Robertson.

When Robertson posted on Quadriga's Facebook page in January 2019 that Cotten had suddenly died — due to complications from Crohn's disease — and later that he was the only person with the passcodes to customer funds, the crypto community was abuzz with theories.

A month after Robertson publicly announced his death, Cotten's estate released a statement in reaction to the "upsetting questions raised" about whether he could possibly still be alive. It included Robertson's account of Cotten's final days in India.

In it, she said that the general manager of the Jaipur hotel helped Robertson with the documents required to have his body transported back to Canada. This included putting her in touch with a medical transportation company.

According to the statement, Cotten was embalmed and placed in a casket and the transportation company flew Robertson and his body to New Delhi. From there, they flew to Halifax on Dec. 11, 2018, where they were met at the airport by friends and family. A closed casket funeral with a small group of family, friends and co-workers was held on Dec. 14.

Jennifer Robertson has declined CBC's repeated requests for an interview for this story. However, through an email from her lawyer, Robertson confirmed that "she was with Mr. Cotten at the time of his death and he is most certainly dead."

Cotten's family wouldn't talk to CBC for the podcast.

None of that changed the fact that more than a quarter of a billion dollars of investor funds was missing. QCX-INT and other creditors formed an online group where they would combine efforts to find out as much as they could about Cotten and the people behind his company.

"At that point, we were desperate to recover funds and we were also convinced that a scam was underway," said QCX-INT.

III. Finding Sceptre

QCX-INT, which stands for "Quadriga Intelligence," spent the next few months running his business by day and spending his nights working on the investigation, driven by a sense of mounting outrage at every new revelation.

He posted his research online and encouraged others to share tips with him in April 2019. He also shared those findings with the RCMP and the FBI.

"It did become an obsession," he said.

A tenacious man in his forties, he's as meticulous in his appearance as in his work. When the CBC interviewed him for the podcast via video chat, he was dressed in a black cap and dark vest, with no logos. "I thrive on detail, I thrive on data. I mean, I'm in the tech space. That's part of my world."

In his attempt to untangle the mystery of Gerald Cotten and Quadriga, QCX-INT began with simple things like domain names and any information he could obtain from historical searches, public records, data leaks online and the Wayback Machine, also known as the Internet Archive, which is a graveyard for dead web pages.

LISTEN | Episode 2 of A Death in Cryptoland:

QCX-INT said that searches alone for the domain names used for Quadriga and Quadriga Financial Services would "yield up a name, an address, an email, a phone number. And those can be revealing, because they can be used to connect to other data points."

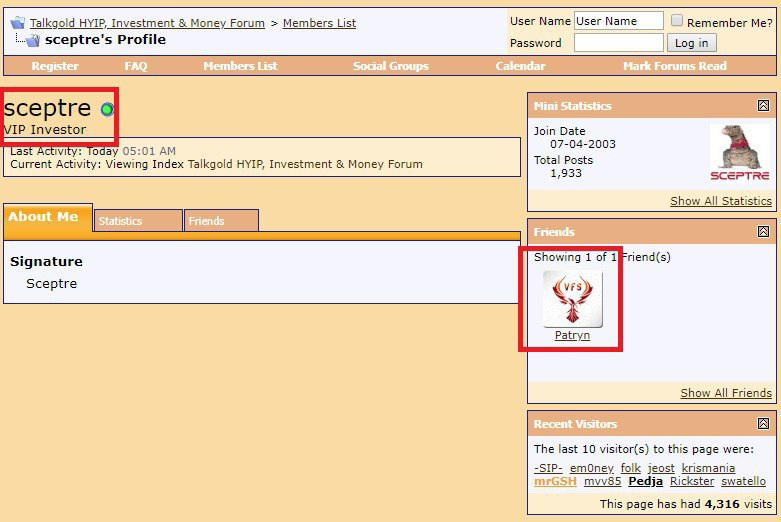

He built a web of connections that linked Cotten to dozens of websites, and ultimately traced him to the online handle Sceptre. "It was a real breakthrough," said QCX-INT. By making that connection, he said, "there's a pattern of activity that doesn't just stretch back a few months, it stretches back years and years."

QCX-INT's sleuthing revealed a history of fraudulent behaviour dating to the summer of 2003, when Sceptre signed on to TalkGold, an online forum where he would promote HYIPs, or high yield investment programs. Essentially Ponzi schemes, they promised very high returns but were unregulated and anonymous, disclosing little or no details about the investment or who was behind it.

Investors on TalkGold used handles like Moolahoops, Skunktoes and Mozart. The exchange of funds between investors and Sceptre would also be anonymous, and they would hide their transactions by using the earliest forms of digital currency.

Although some investors may have been genuinely misled, for the most part, it was like online gambling. The more people that bought into the scheme, the more money you made, as long as you were among the first ones out. The last ones out would be left holding the bag.

"People would at first see a return on their investment. And if they wanted, they could pull their money out. But eventually, usually within, like, a matter of weeks or sometimes months, the website would just go offline," said Joe Castaldo, a business reporter at the Globe and Mail who also investigated Cotten's early activities on TalkGold.

"The operator would disappear and people lost their money. And there was no way, no recourse for them, because they didn't know who was running the website. The digital currency transactions were completely anonymous. There's no way to trace them. So they just lost their money and that was it."

"You don't really realize just how childlike he was."

Just as one of Sceptre's schemes would dry up, leaving angry investors in the lurch, he would set up a new one. Cotten would have been just 15 years old at the time.

During this research, QCX-INT also found a handful of websites linked to Cotten that offered a proxy service that would reroute a user's internet connection so that their IP address would be hidden — websites with names like Cloakedproxy.com and HowdoIhidemyip.com. It appears he was creating sites that helped other people disguise themselves in the digital space.

In a screen capture from the Wayback Machine, one of those websites reads: "You can access virtually any site through our servers, and your boss or teachers won't know about it!"

During QCX-INT's investigations, the discovery that gnawed at him the most was a YouTube channel called GerryRulz. It was Cotten's personal account, and featured videos he had posted of himself in his early twenties.

"I think until you see him on video and in kind of his private life, you don't really realize just how childlike he was," QCX-INT said.

There was Cotten hanging his brother, Bradley, over a railing by his legs in an experiment to see whether he could drink upside down. There were also videos of Cotten burning various items — a Winnie the Pooh doll, a walnut, hair mousse, even Pokemon cards.

The one that struck QCX-INT the most was Cotten taking a $20 bill and melting it in the microwave. That video was posted in 2012, about a year before Cotten launched Quadriga with Michael Patryn. QCX-INT saw it as an omen.

The burning of money "was actually quite sickening to watch," he said. "It made me extremely uneasy — just the thought that this guy had been in charge of several hundred million dollars and that myself and other Quadriga customers or creditors had trusted him with our funds."

IV. When Gerry met Michael

After the news of Cotten's death emerged in January, Michael Patryn, Quadriga's co-founder, told CBC News that Cotten once admitted to him that he "didn't open up to many people."

But Patryn said "he was able to open up to me and he was like a brother to me."

Asked how they had met, Patryn said Cotten had been living in Ontario and he had been in Montreal when they ran into each other at a few group events, before settling in Vancouver in 2013.

During the reporting for the podcast, CBC asked Patryn if he had met Cotten on TalkGold.

He responded by email, "I met Gerry in person at a restaurant in Ontario. We did not meet online on any forum."

But QCX-INT's vast trail of data points connected the two on TalkGold, where Patryn operated under his last name. It's not clear when the two first met online, but there are posts of Sceptre and Patryn interacting that date back to 2004.

"You go back and you look at a pattern of posts on TalkGold... they're kind of running flank and running cover for each other and that extends out in other forums," QCX-INT said. "Sceptre and Patryn were like two peas in a pod."

When Patryn suddenly disappeared from TalkGold in October 2004, posts about him being a convicted felon started to appear on the forum. Around that time there was news of arrests of individuals involved in a criminal network of fraudsters.

For many years, Patryn passed it off as just rumours, misinformation spread by his enemies and competitors. But despite his denials, his past is well-documented in public and court records. Not only that, those records reveal that Michael Patryn isn't even his original name.

Born Omar Dhanani, he changed his name twice, to Omar Patryn and years later to Michael Patryn.

In 2005, at the age of 22, Omar Dhanani pleaded guilty for his role in an identity theft ring called Shadowcrew.com. It was an online marketplace where people could buy stolen bank and credit card numbers, passports and other wares to commit identity fraud.

According to Brett Johnson, one of the creators of Shadowcrew.com, Dhanani was a money mule who went by another alias, Voleur (or "thief" in French). Johnson, an ex-felon-turned-podcaster, says Dhanani offered a service laundering illicit funds through an anonymous digital currency called E-Gold.

"Omar began offering ... a prepaid debit card," Johnson said in an interview with the CBC. "You'd send him 500 dollars with E-Gold. He would charge maybe five, eight per cent. And then he would put, you know, 450 dollars ... onto the prepaid debit card so you could take it to an ATM and cash it out."

Johnson explained that two decades ago, cryptocurrency didn't exist as it does today, but that E-Gold, in principle, was like bitcoin.

Johnson said bitcoin is "just a means to transfer value" and that E-Gold "is a precursor to today's cryptocurrency. The only thing that E-Gold lacked was the blockchain."

Shadowcrew.com was eventually shut down by the United States Secret Service. Omar Dhanani was sentenced to 18 months in prison in the U.S. and then deported to Canada.

Michael Patryn eventually admitted to CBC that he'd done time, but added that these were the past transgressions of a young man.

Serving "a few months in a foreign country for a white collar crime" was "generally considered to be an unfortunate part of your childhood that you suffered the consequences for. Not a lifelong badge of dishonor," Patryn wrote in text messages with the CBC during the reporting of this story.

In a more recent email exchange with CBC in response to questions about his role in Shadowcrew.com, Patryn downplayed it, calling the takedown a show.

"U.S. law enforcement referred to all unlicensed crypto exchanges as money laundering and dark nets as 'international criminal organizations.' This allowed for more of a media spectacle, while arresting children selling credit card numbers over the internet," he wrote.

The American authorities would eventually bust Liberty Reserve.

In the year following his release from prison, Omar Patryn officially changed his name to Michael Patryn and set up another digital currency exchange operating on the web called Midas Gold. It operated as an intermediary, selling digital currencies for a business out of Costa Rica called Liberty Reserve. M-Gold offered its clients anonymity in sending and receiving funds internationally.

The American authorities would eventually bust Liberty Reserve, shutting down what it called at the time the largest international money laundering operation in history, and putting its CEO, Arthur Berdovsky, behind bars.

That case caught QCX-INT's attention while he was doing his research, prompting him to request hundreds of pages of court documents from the Southern District of New York.

"It was a little bit of a long shot going through that data, but I got a hit," he said. Buried in hundreds of pages of court filings, QCX-INT found Gerald Cotten's email address listed as Midas Gold's contact.

No criminal charges were ever laid against Cotten or Patryn in relation to the case, but the shuttering of Liberty Reserve effectively put Midas Gold out of business in May 2013.

But the two would be back in business later that year, launching a cryptocurrency exchange called QuadrigaCX.

V. Where's the money, Gerry?

While QCX-INT dug up a lot of information on Cotten and Patryn's history prior to forming Quadriga, a motherlode of information about what actually went down at the crypto exchange came through more official channels.

After Quadriga's spectacular collapse in January 2019, the Supreme Court of Nova Scotia appointed Ernst and Young to look for the missing quarter of a billion dollars owed to creditors, with the most shocking report released in June 2019. The Ontario Securities Commission (OSC) also did their own investigation and released the results of their review in June 2020.

What was clear in both of their findings was that Quadriga's asset shortfall was a result of Cotten's fraudulent activity. "What happened at Quadriga was an old-fashioned fraud wrapped in modern technology," the OSC report said.

Cotten created fictitious accounts and was trading at times in fake dollars and fake bitcoin. His largest account was under the alias Chris Markay and at one point, he credited himself with single deposits of $100 million and $50 million dollars, respectively. He had other fake accounts, too: Aretwo Deetwo, Seethree Peaohhh — and Sceptre Gerry.

The OSC report also found that in the first year of operation, Cotten was involved in the majority of trades on Quadriga. Unbeknownst to customers, he was the counterparty in more than 87 per cent of the bitcoin trades done on his own company's platform in 2014.

“He couldn’t control himself ... and blew just an absolutely eye-popping amount of money.”

The investigations also uncovered that Cotten mixed customer funds with his own. The Ontario securities regulator found that between 2016 and 2018, Cotten transferred millions of dollars of his clients' funds to his and Robertson's personal accounts to buy multiple properties, and fund their living and travel expenses.

QCX-INT couldn't get that kind of access to Cotten's activities, but he wasn't surprised by the OSC's findings. To QCX-INT, it followed a pattern of "impulsive behaviour."

"He couldn't control himself, by the looks of things, and blew just an absolutely eye-popping amount of money," he said.

The OSC reported that Cotten used his customer funds for speculative trades on other cryptocurrency exchanges. And when the price of bitcoin was crashing, he'd try to make up for losses by essentially gambling customer funds, digging himself into a hole.

"He was an inveterate gambler … an abysmal trader who lost tens of millions on some of these speculative trades," QCX-INT said.

So in the end, when customers wanted to withdraw funds, Cotten became dependent on new money coming into the exchange. And the gap between the real and the fake money just got bigger.

"Quadriga was a house of cards, and then it was a Ponzi scheme," said journalist Amy Castor. "I mean, where were the regulators?"

Quadriga had been registered with the British Columbia Securities Commission, which issued a cease trade order in 2016, when it failed to file financial statements.

It was also registered, in its early years, with FINTRAC, Canada's money laundering watchdog, as a money service business. The agency would not comment on what it did — if anything — to ensure Quadriga followed regulations. A spokesperson for FINTRAC wrote to CBC that the agency was prohibited by law to disclose that information to the public.

Patryn says he had no idea what Cotten was up to, insisting he parted ways with the company in January 2016 over a disagreement with Cotten about listing Quadriga on the Canadian Securities Exchange. The company never did go public, and although Patryn remained a beneficial shareholder — holding more than 18 per cent of the company's shares, according to an affidavit he filed in court — it would appear that Cotten controlled the company from 2016 until its collapse.

In a statement released in October 2019 in response to the revelations of fraud in the Ernst and Young reports, Jennifer Robertson said she was unaware of Cotten's "improper actions," that "she was not aware of, nor did she participate in Gerry's trading activities, nor his appropriation of customer funds."

She added that she was "upset and disappointed" to learn about what Cotten had been up to.

In a voluntary settlement agreement made in the fall of 2019 as part of the company's bankruptcy, Robertson offered to return $12 million worth of assets to Quadriga creditors, assets she says she believed were purchased legitimately with Cotten's earned profits, salary and dividends.

Of the roughly 76,000 creditors who had money tied up on the exchange, in the end, only 17,000 made claims. About $46 million was recovered, and each creditor is expected to get about 10 per cent back, although the process is still ongoing.

The RCMP would not comment on the creditors' call to exhume the body, nor would police comment on the ongoing investigation. The FBI is also mum and won't comment until the case is closer to completion.

Creditors who have contacted the RCMP are frustrated by what appears to be a lack of action on the part of the law enforcement agency.

"It's theft," said QCX-INT. "You know, it's like a $200-million bank job could happen, and you've got a law enforcement agency that does next to nothing about investigating it."

QCX-INT was in contact with a fraud investigator in the RCMP's financial crime unit in the Toronto area, providing him with results of his data investigation and information gathered through sources along the way.

"Even when there is hard evidence of fraud provided to them, you know, they would continually come back and say to us, 'We need more evidence, even in order to investigate,'" he said. "I felt like I actually had to present them with a bloody corpse and a gun with fingerprints on it in order just to get them to investigate."

"I'm not convinced he's dead."

Amy Castor, the journalist, said that Cotten "had been running Ponzi [schemes] from the time he was a kid." Based on what has emerged since his disappearance, "he was operating a massive Ponzi scheme and it was going down in a big way. He knew he'd have to face the piper. So he had to either face maybe going to jail for fraud or find another way out of there."

Without official confirmation from RCMP that the body buried in Halifax is that of Gerald Cotten, suspicions persist about whether he could still be out there.

"I'm not convinced he's dead," Castor said. "I wouldn't be surprised if one day, you know, we saw a press release come out from the U.S. Department of Justice that said he was arrested somewhere. I wouldn't be surprised if other people were implicated in his exit scheme."

QCX-INT believes the balance of probabilities points to Cotten being dead, but said he'd be happy to be shown otherwise.

In the meantime, he continues to keep an eye on the blockchain. He said funds are still moving in accounts connected to Quadriga, and that the activity is "unusual." He wouldn't elaborate further, for fear of compromising active investigations.

"We are not treating this as closed. There are still individuals out there who we believe have benefited from the fraud of Quadriga. Now, we've got some suspicions about who that might be. And that means that they don't want me to be doing what I'm doing."

With files from Eunice Kim, Yvette Brend and Rignam Wangkhang